Financial freedom is a dream for every individual, especially for those in the age group of 20 to 50 years, who are in their prime earning and responsibility years. Achieving this freedom requires disciplined planning, regular savings, and smart investments. One of the most effective ways to build wealth while maintaining flexibility is through a Freedom SIP (Systematic Investment Plan).

What is Freedom SIP?

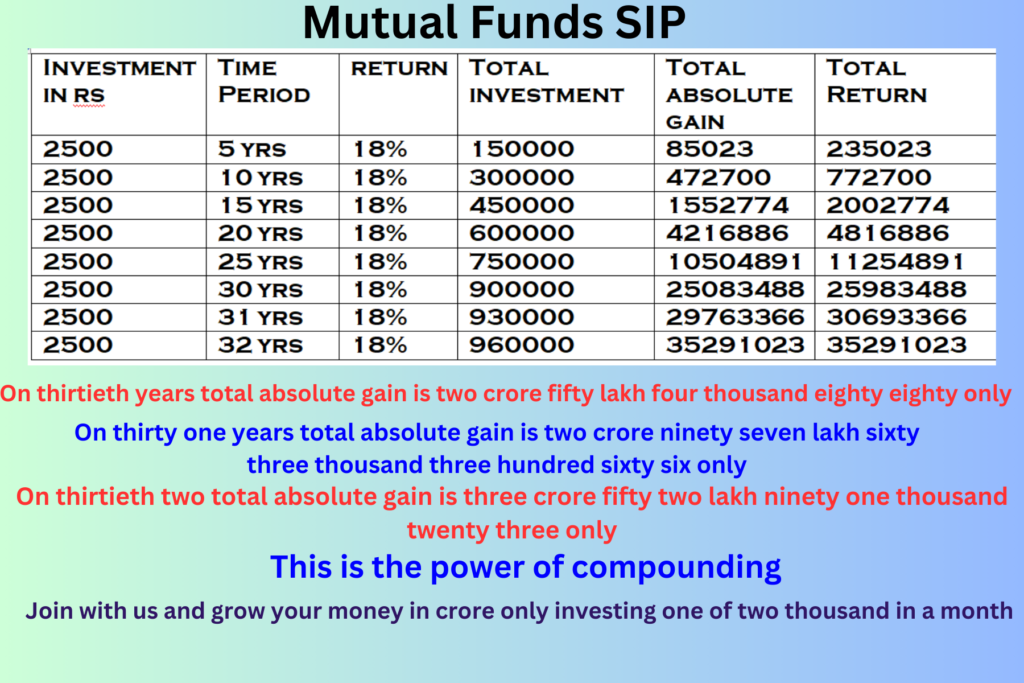

Freedom SIP is a unique investment approach designed to combine the power of Systematic Investment Plans (SIPs) in mutual funds with the benefit of building long-term wealth and financial security. It encourages investors to save regularly, invest systematically, and create a corpus that supports financial independence in the future. Unlike traditional savings options, SIPs allow you to invest small amounts every month and enjoy the benefits of compounding over time.

Why Freedom SIP is Perfect for Ages 20–50

The age group of 20 to 50 years is crucial because:

- At 20–30 years: You are just starting your career, with fewer responsibilities. Investing early gives your money maximum time to grow. Even small SIP amounts can become a significant corpus over 20–30 years.

- At 30–40 years: Responsibilities like family, children’s education, and home loans increase. Freedom SIP helps you balance current expenses while ensuring your long-term goals are not compromised.

- At 40–50 years: Retirement planning becomes more important. A disciplined SIP approach helps build a financial safety net to support retirement, children’s higher education, and healthcare needs.

Benefits of Freedom SIP

- Power of Compounding – Small investments grow exponentially over time when invested regularly.

- Flexibility – You can start with as little as ₹500 per month and increase as your income grows.

- Goal-Based Planning – Whether it’s retirement, child’s education, marriage, or wealth creation, SIPs can be tailored to your goals.

- Financial Discipline – A fixed monthly investment instills financial discipline, ensuring you save before you spend.

- Inflation-Beating Returns – Mutual fund SIPs have the potential to generate higher returns than traditional savings accounts and fixed deposits, helping your money beat inflation.

- Freedom to Live Stress-Free – With a strong financial base, you can achieve freedom from financial worries and focus on living life to the fullest.

Example – The Power of Early SIP

- If you start a Freedom SIP of ₹5,000 per month at age 25, with an average return of 12% annually, in 25 years (by age 50) you can accumulate around ₹95 lakh to 1 crore.

- If you delay and start the same SIP at age 35, the same investment will grow to only around ₹30–35 lakh by age 50.

This shows how starting early gives you the true advantage of compounding.

Why Choose Sagarika Digital for Freedom SIP?

At Sagarika Digital Financial Investment Services, we understand that every individual has unique dreams and responsibilities. We provide:

- Expert guidance on selecting the right mutual funds.

- Personalized SIP plans for young professionals, families, and business owners.

- Regular monitoring and portfolio review.

- Transparent and hassle-free investment process.

Conclusion

Freedom SIP is not just an investment – it’s a lifestyle choice for financial independence. For people between 20 and 50 years, it ensures that your money works for you while you focus on your career, family, and aspirations. The earlier you start, the greater the rewards. Secure your future today with a Freedom SIP through Sagarika Digital and take the first step towards financial freedom.