In today’s fast-paced world, achieving financial freedom is one of the most important goals for individuals and families. With rising expenses, inflation, and uncertainty about future income, it is essential to build wealth through disciplined investing. Among the various investment options available in India, Systematic Investment Plans (SIPs) in mutual funds have emerged as a highly popular and effective method of long-term wealth creation.

While SIPs themselves have been around for years, the concept of Freedom SIP has gained momentum as a structured and goal-based investment strategy. Freedom SIP is designed to help investors plan for financial independence, retirement, or long-term goals by providing flexibility, systematic growth, and the power of compounding.

This blog will provide a comprehensive knowledge-sharing guide on Freedom SIP, its benefits, and how different mutual fund companies in India offer unique SIP schemes to meet diverse investor needs.

What is a Freedom SIP?

A Freedom SIP is not just a regular SIP where you invest a fixed amount every month. Instead, it is a goal-oriented investment approach that allows investors to gradually build a retirement corpus or long-term wealth while ensuring systematic withdrawals in the future. In simple terms:

- Accumulation Phase – You invest regularly through SIPs in selected mutual funds for a certain number of years (e.g., 8–10 years).

- Freedom Phase – After this period, your SIP contributions are automatically converted into a Systematic Withdrawal Plan (SWP), giving you monthly payouts like a second salary.

This dual benefit makes Freedom SIPs highly suitable for those planning early retirement, passive income, or financial independence without depending entirely on salary or pension.

Key Benefits of Freedom SIP

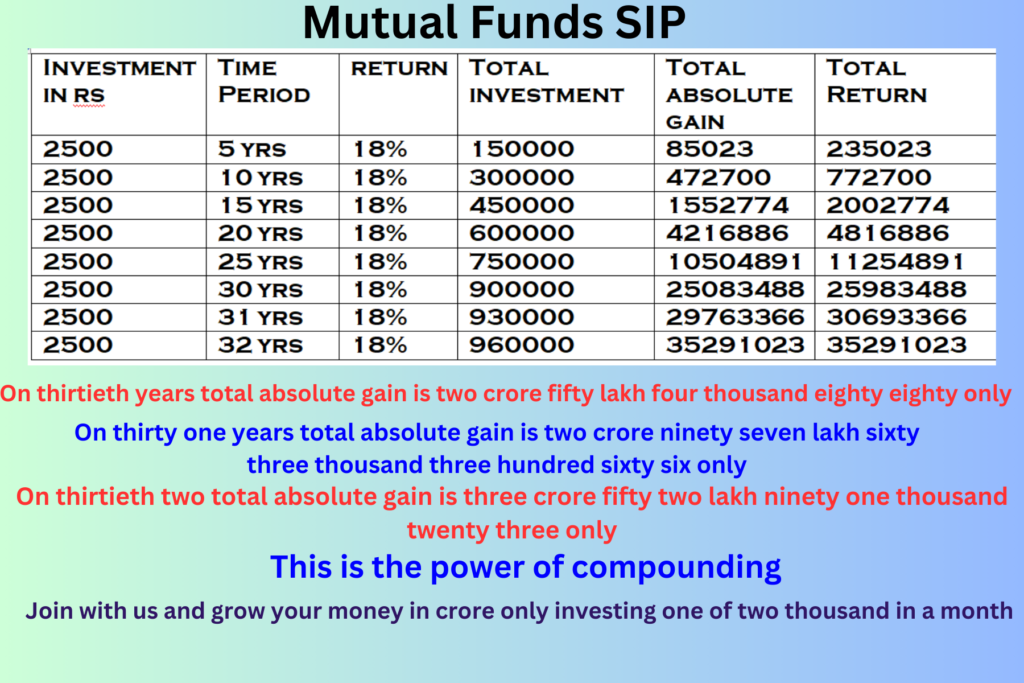

1. Power of Compounding

The biggest advantage of SIPs is compounding. By investing early and regularly, your money earns returns, and those returns generate further returns over time. Freedom SIPs leverage this power to create a large corpus that can support your financial independence.

2. Disciplined Wealth Creation

Freedom SIPs encourage disciplined investing. Since the contributions are automated, you avoid emotional decisions and market timing. This regularity builds a strong foundation for financial stability.

3. Inflation-Adjusted Income

Unlike fixed deposits or pensions that may lose value due to inflation, SIP-linked withdrawals from equity-oriented mutual funds have the potential to grow faster than inflation, helping maintain your purchasing power.

4. Tax Efficiency

Mutual funds, especially equity-oriented ones, offer favorable tax treatment compared to traditional investments. Long-term capital gains (LTCG) up to ₹1 lakh per year are tax-free, making Freedom SIPs a tax-efficient option.

5. Flexibility

You can choose your SIP amount, tenure, withdrawal structure, and even switch funds depending on your needs. This flexibility is rarely available in traditional investment products.

6. Achieving Early Retirement

Many young professionals are adopting the FIRE (Financial Independence, Retire Early) philosophy. Freedom SIPs are designed to meet this aspiration by building a large enough corpus that can provide regular income before the conventional retirement age.

How Different Mutual Fund Companies Offer Freedom SIPs

Several leading Asset Management Companies (AMCs) in India have launched Freedom SIPs or similar structured plans to cater to the growing demand for financial independence. Let’s look at some of the most popular options:

1. Nippon India Mutual Fund – Freedom SIP

Nippon India was among the first to launch a dedicated Freedom SIP plan. Investors can choose to invest through SIP for a fixed duration (like 8, 10, or 12 years). After this accumulation period, the investment automatically shifts to an SWP mode, giving monthly payouts.

- Key Features:

- Freedom to choose investment amount and tenure.

- Multiple withdrawal options after accumulation phase.

- Available in popular equity funds like Nippon India Growth Fund.

- Best For: Young investors planning long-term financial independence or early retirement.

2. ICICI Prudential Mutual Fund – SIP with SWP Strategy

While not directly branded as “Freedom SIP,” ICICI Prudential allows investors to create a SIP-to-SWP structure, ensuring smooth transition from accumulation to withdrawal.

- Key Features:

- Wide range of funds (equity, hybrid, debt).

- Customizable withdrawal amounts.

- Suitable for both conservative and aggressive investors.

- Best For: Investors seeking flexibility in fund choice and withdrawal design.

3. HDFC Mutual Fund – Systematic Investment to Retirement Planning

HDFC Mutual Fund emphasizes retirement planning through SIPs that convert into SWPs. Though branded differently, the concept is similar to Freedom SIP.

- Key Features:

- Long-standing reputation and trust.

- Focus on retirement-linked SIP strategies.

- Flexibility to extend SIP tenure or modify withdrawal plan.

- Best For: Risk-averse investors looking for trusted retirement-focused solutions.

4. SBI Mutual Fund – Smart Freedom through SIPs

SBI Mutual Fund promotes SIPs as a way to financial freedom by building a large retirement corpus. Their calculators and retirement planning tools allow investors to simulate future payouts.

- Key Features:

- Government-backed credibility.

- Access to wide retail investor base.

- Strong digital tools for retirement planning.

- Best For: First-time investors seeking trust and transparency.

5. Aditya Birla Sun Life Mutual Fund – Goal-Based SIPs

Aditya Birla focuses on goal-based SIPs, where Freedom SIP is one of the options. The structure allows investors to set specific retirement or early financial independence goals.

- Key Features:

- Goal-tracking features.

- Multiple equity and hybrid schemes to choose from.

- Flexibility in investment and withdrawal design.

- Best For: Investors looking to track and achieve specific life goals.

6. Axis Mutual Fund – Long-Term SIP Strategies

Axis Mutual Fund emphasizes wealth creation through long-term SIPs with options to design structured withdrawal plans later. While not branded as Freedom SIP, the framework is similar.

- Key Features:

- Strong equity fund performance.

- Options for retirement planning.

- Digital-first approach for ease of investment.

- Best For: Tech-savvy millennials aiming for financial freedom.

Freedom SIP vs Traditional SIP

It’s important to understand the difference between a Freedom SIP and a Regular SIP:

| Feature | Regular SIP | Freedom SIP |

|---|---|---|

| Objective | Wealth creation | Wealth creation + regular income |

| Tenure | Flexible | Fixed accumulation period + withdrawal phase |

| Returns | Market-linked | Market-linked |

| Payouts | Only on redemption | Automatic monthly SWP after tenure |

| Best For | Investors seeking long-term growth | Investors seeking financial freedom / early retirement |

Why Investors Should Consider Freedom SIPs

- Provides a second source of income during retirement or even before.

- Reduces dependency on traditional savings like FDs, which may not beat inflation.

- Encourages goal-based investing rather than random investments.

- Highly suitable for young professionals, freelancers, and entrepreneurs aiming for passive income.

- Acts as a structured retirement solution without the rigidity of pension plans.

Things to Keep in Mind Before Starting a Freedom SIP

- Choose the Right Fund: Equity-oriented funds are ideal for long-term growth, but hybrid funds may be safer for conservative investors.

- Start Early: The earlier you start, the smaller your required SIP amount for the same goal.

- Stay Invested: Avoid stopping your SIP during market volatility. Long-term wealth creation requires patience.

- Understand Risk: Mutual funds are subject to market risk. Consult with a financial advisor to match your risk profile.

- Use Online Calculators: Most AMCs provide calculators to help you plan the SIP amount and tenure for desired financial freedom.

Example Calculation: Freedom SIP in Action

Suppose you invest ₹15,000 per month for 10 years in an equity mutual fund with an expected annual return of 12%.

- After 10 years, your corpus = ~₹34 lakh.

- This corpus then shifts into an SWP, giving you ~₹25,000 per month for the next 15 years (assuming moderate growth).

This example shows how a well-planned Freedom SIP can provide steady income like a pension, while still allowing your money to grow.

Conclusion

The concept of Freedom SIP is a powerful tool for today’s investors who wish to achieve financial independence, early retirement, or simply create a secondary income stream. By combining the discipline of SIPs with the flexibility of SWPs, mutual fund companies like Nippon India, ICICI Prudential, HDFC, SBI, Aditya Birla, and Axis Mutual Fund are making wealth creation more structured and goal-oriented.

For investors, the key is to start early, invest regularly, and stay invested. Freedom SIP is not just about money—it is about creating a life of choices, security, and independence. Whether you are a young professional, a middle-aged family person, or someone planning early retirement, Freedom SIP can be your gateway to financial freedom.